How to Plan a Budget for Retirement

If you are in your early retirement years, you should create a budget to prepare for the various costs you will face as you near the conclusion of your working life. Your medical and long-term care bills may seem daunting as you approach retirement age. These costs are among the most difficult to account for when preparing a retirement budget.

Medical expenses are burdensome if you retire before you get to age 65

Medical bills in retirement are one of many people's most significant financial issues. While health care may not be the first item that comes to mind, planning for these costs now might help you avoid huge shocks later on.

Accurately assessing your demands is one of the greatest methods to plan for healthcare expenditures. If you haven't already, seek an estimate from a financial professional or a health insurance specialist. The correct estimate will assist you in saving for these future costs. This estimate may be used as a guideline to calculate how much you should spend for them each year.

Setting up a tax-advantaged account for healthcare bills in retirement is another effective method to plan for them. Roth IRAs, 401(k)s, and other tax-deferred accounts are examples of these accounts. They can assist you in funding your healthcare demands while also avoiding coverage gaps.

You should plan for additional potential expenditures in addition to investing in healthcare in retirement. This includes increased dental and long-term care expenditures. You can also consider purchasing a permanent life insurance policy to bolster your retirement funds.

To be safe, you should educate yourself about Medicare, Medigap, and other healthcare alternatives. Take the time to compare rates and deductibles as well. Keep in mind to browse around for the greatest value for your money.

To be safe, you should educate yourself about Medicare, Medigap, and other healthcare alternatives. Take the time to compare rates and deductibles as well. Keep in mind to browse around for the greatest value for your money.

Starting to save early is one of the most significant things you can do to prepare for future medical bills. Health care is one of the most expensive aspects of retirement, and accurate estimates can help you avoid spending all of your hard-earned savings.

Healthcare inflation continues to outperform overall inflation, and your healthcare costs may account for most of your retirement budget. Take the time to think about these things before making your next big move. You may ensure that you are financially prepared for the period of your life by doing so.

Disciplined spending for retirement

Financial discipline is essential for good financial health, and one of the most crucial skills to master is the ability to create and stick to a plan. Many people lack formal financial management education and are unaware of how to make sound financial decisions. The good news is that studying the fundamentals may yield immediate benefits.

Getting rid of debt is one of the finest strategies to improve your financial discipline. Credit cards, personal loans, and mortgages are examples of such indebtedness. Dealing with debt can make investing easier and allow you to save more money.

You should also think about investing in a tax-advantaged account. Various sorts of tax-favored accounts are available to help you achieve certain goals, such as retirement, education, and healthcare. This will ensure that you can live comfortably in retirement.

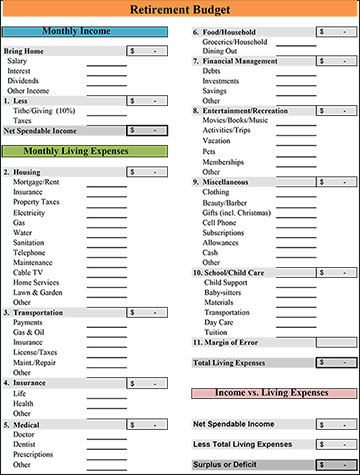

A budget can help you keep track of your expenditures. A monthly allowance is a wonderful place to start. Make certain that your expenditure does not surpass your budget. Set aside money each month for fun, whether it's for lunch with friends or a movie night.

You might hunt for deals if you want to cut back on your expenditures. There are applications that can help you keep track of your costs. Consider utilizing a spreadsheet to keep track of your expenses.

You may be making costly financial blunders if you don't have a budget. If you live in a favorable market, you could be more willing to spend money on “nice to have” products. However, if you live in a bad market, you may be less willing to spend more money.

You may make changes to your budget once you've established one and understand how much you're spending. Wait until you're certain you'll need the item before purchasing it. Otherwise, you risk making a huge buy that exceeds your budget.

Most responsible savers have diversified their assets and resources and are aggressively saving. Depending on your savings goals, you can choose between a fairly aggressive withdrawal pace and a more prudent withdrawal rate.

Long-term care costs

If you're saving for retirement, you may have budgeted for long-term care expenditures. This is not a situation to be treated lightly. Fortunately, there are methods to prevent or at least mitigate the financial impact of long-term care bills.

First, calculate your healthcare costs. Long-term care services can range from assistance with everyday tasks to medical care. Then select how you're going to pay for those services. You can get help from various sources, including health insurance and financial assets.

The expense of long-term care for certain retirees is covered by Medicaid, which covers one-third of the cost. Other alternatives include a home equity loan, life insurance with a long-term care rider, or annuities with long-term care benefits.

Your strategy should also take into account your specific demands as well as the resources available. Your premiums will be affected by your age, gender, and health.

One-time purchases and changes might also have an impact on your budget. Keeping a separate pool of assets for out-of-pocket payments is a good idea. However, this might expose you to unanticipated charges.

As the population ages, so will the demand for long-term care. President Biden has proposed a $400 billion investment in the community and home care. Furthermore, health insurance premiums make for a significant amount of seniors' healthcare costs.

Long-term care insurance coverage can aid in covering the costs of a nursing home, assisted living facility, or other institution. For the middle-market consumer, several insurers provide streamlined plans.

There are various options for funding your long-term care costs, including annuities with long-term care provisions, life insurance, reverse mortgage profits, and a hybrid of the two. You can use this money to pay for one year or multiple years of treatment.

Long-term care expenditures might be prohibitively expensive, but they do not have to bankrupt you. Your resources might become a component of your retirement plan if you use them effectively. It's critical to do it properly whether you buy insurance, employ a reverse mortgage, or self-fund.

The earlier you begin to plan for long-term care, the better off you will be.

The post How to Plan a Budget for Retirement appeared first on https://werbloggers.com

The post How to Plan a Budget for Retirement appeared first on https://gqcentral.co.uk

Comments are closed